Sending your child to study abroad can be expensive. As a parent, you want to give your child a world-class education, which requires thoughtful financial planning as early as possible.

Here are 3 reasons why you need to start saving now for your child’s education abroad:

1) The cost of education is rising faster than the cost of living:

Along with items such as food, clothing and housing, the cost of education has also been consistently rising, only faster. And while the phrase ‘education inflation’ may seem daunting, knowledge is power.

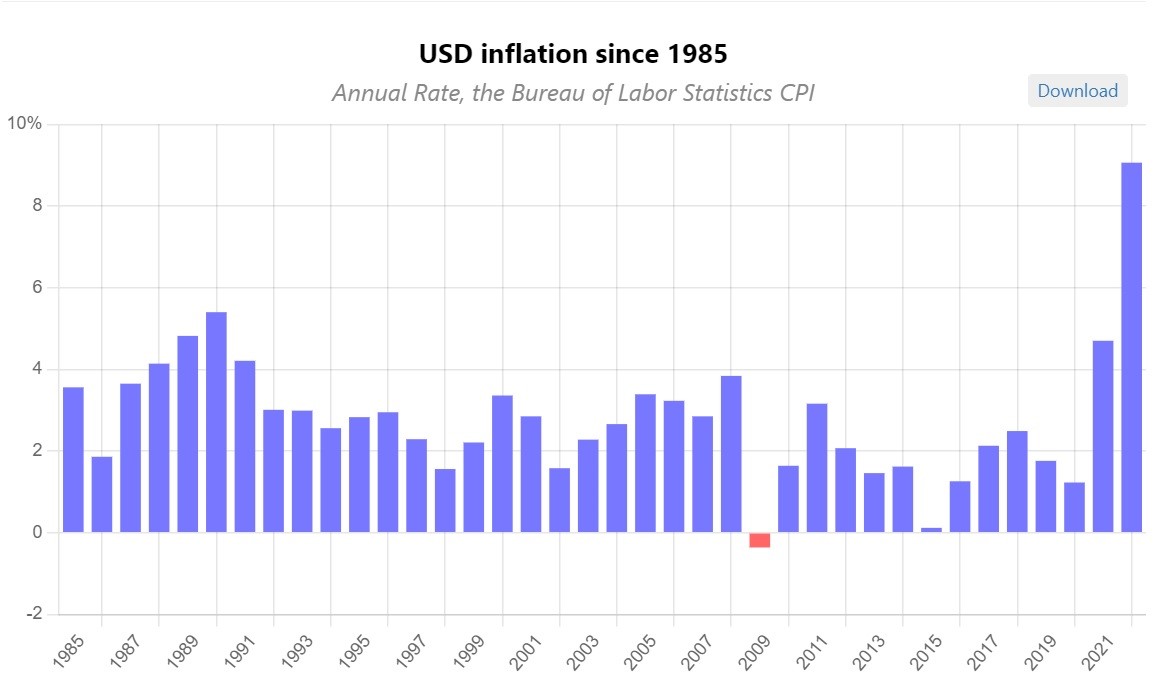

Let’s break this down: We know universities abroad come with a sizable price tag, which increases every year. This phenomenon is called education inflation. In the US, for example, the average cost of a four-year degree, in institutions such as Tufts University, rose from USD 16,133 for the 1985-86 academic year to USD 63,804 for the 2022-23 year. That’s nearly a 300 percent increase in the cost of education in 37 years! However, during the same timeframe, CPI data shows that the US inflation rate increased by 175 percent, which is a significant difference.

Source: www.in2013dollars.com/us/inflation/1985?amount=1

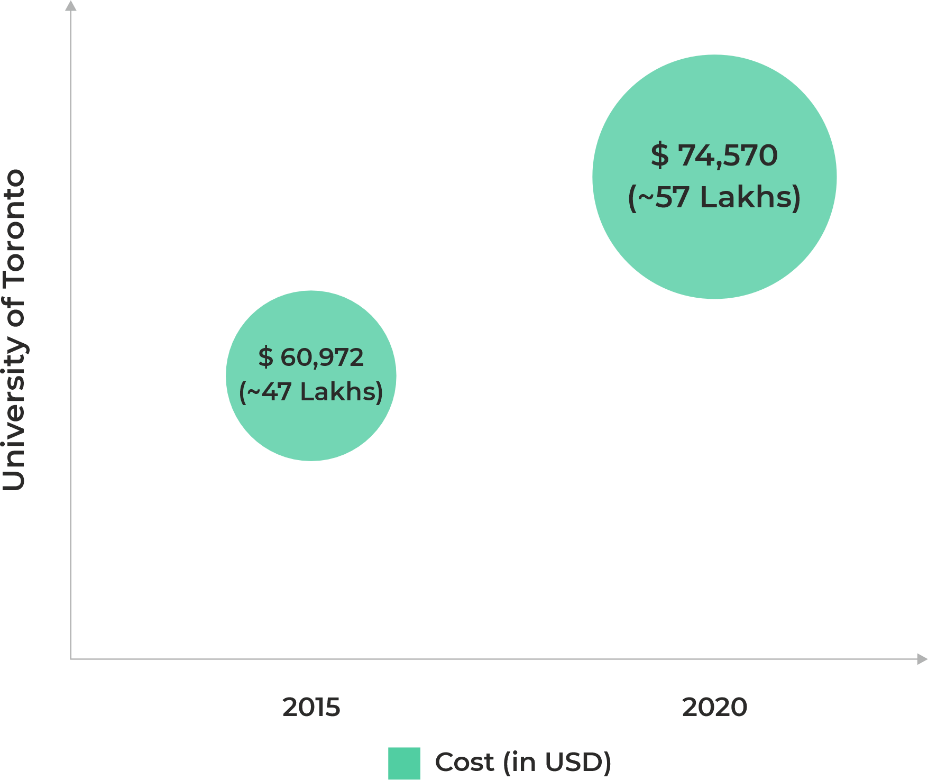

Other universities around the globe have also followed these trends. The cost of tuition in countries such as the UK, Canada, and Australia has also increased at staggering rates.

Source: EduFund Research team

2) It’s not just about the tuition:

There are several additional expenses apart from the tuition fee that can drive up the cost of education. Overheads, such as accommodation, vary according to the city. Living and studying at universities in big cities such as New York and London are invariably more expensive than in smaller cities and college towns such as Ithaca and Raleigh-Durham. Overheads also extend to transportation, food, household items and entertainment. Books and school supplies can sometimes surpass USD 1,000 a year. Universities also expect students to either have or purchase health insurance, which is expensive. Another hidden cost to consider is the cost of travel to and from home, as many students wish to come home for their winter or summer break. To help break down ancillary costs, here’s a checklist to help you plan better.

| Ancillary college costs |

|---|

| Accommodation fees (on or off campus) |

| Living expenses (groceries, dining out, transportation, personal shopping and entertainment) |

| Books and supplies |

| Medical expenses (insurance) |

| Travel (to & from India and with friends) |

3) The rupee doesn’t always help:

A parent who aspires to send their child to study abroad faces the consequence of education inflation and rupee depreciation.

For example, in the chart below, we’ve kept the tuition and living expenses constant for 17 years, which is usually not the case. As you can see, the rupee falls dramatically against the dollar during the same timeframe. This steep decline leads to a whopping 61 percent increase in the price of tuition for an Indian student!

| Currency | January 2004 | June 2021 | |

|---|---|---|---|

| Tuition | Dollar | 50,000 | 50,000 |

| Living expenses | Dollar | 75,000 | 75,000 |

| Total cost (tuition + living) | Dollar | 75,000 | 75,000 |

| 1 USD = | Rupee | 45.45 | 73.32 |

| The total cost of college | Rupee | 34,08,750 | 54,99,000 |

| Increase | 61% |

It’s easy to convince yourself that you will think about your child’s education finances when the time comes. But when that time arrives, many parents are often shocked at the expenses they have to incur. Financially planning for your child’s education abroad is easier than you think. You can start saving money by investing it in instruments that offer substantial returns. Doing so will help you meet, if not beat, education inflation. Furthermore, the law of compounding has taught us that if we’re disciplined and contribute to our monthly savings, we are more likely to see our money grow. This is what will eventually play a huge role in securing funds for your child’s education in the future.

Should you need any assistance in planning your finances, EduFund can help. However, if you’re looking to navigate and explore the complex ecosystem of undergraduate, postgraduate and MBA programmes abroad, get in touch with The Red Pen for more advice.

Eela Dubey is the Co-founder of EduFund. She holds an undergraduate degree in political science and French from New York University. She has a background in finance and has a robust understanding of the world of investments and business. Through EduFund, she brings together the ethos of determination and empathy with the goal of changing the way Indian parents save for their children’s future.