Every parent wants to give their children a world-class education. One way to ensure that is to send them to a reputed university abroad. According to the Bureau of Immigration, nearly 6.5 lakh Indian students travelled to different countries for further education in 2022, indicating that many Indian parents believe in the quality of education abroad. But an international education is an expensive endeavour. To create a substantial corpus for their child’s education, parents must understand the obstacles well in advance to beat them.

Why is an education abroad so expensive?

Education costs are steadily increasing along with necessities such as food, clothing, and housing. Here are the two most significant contributing factors:

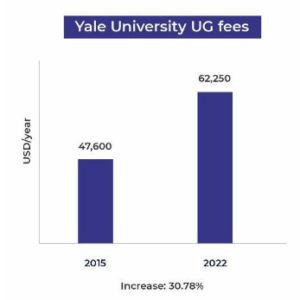

1) Education inflation

Educational inflation refers to the rising cost of education over time. It frequently results in fewer individuals having the means to pay for education. Between 1980 and 2020, the costs of studying in a US university increased by a staggering 1,200 percent!

But apart from the tuition fees, parents also need to consider living expenses which are a significant portion of the education cost. A Georgetown University Center on Education and the Workforce report revealed the average living expenses for an undergraduate degree rose by 169 percent between 1980 and 2020.

Source: EduFund Research

Education inflation is not exclusive to the US. Many countries, including Canada, the UK, and Australia, are seeing rising education costs. Here are some examples:

- The fee for humanities and communication courses increased by 113 percent in most universities in Australia between 2020 and 2021.

- International graduate students in Canada saw a 4.3 percent rise in tuition fees between 2022 and 2023.

- Recently, university vice-chancellors in England and Wales asked for an increase in tuition fees, which means that the annual cost of studying in the UK may rise to around £12,000 or 13,000 from £9,250.

2) Currency depreciation

The Indian Rupee (INR) has a long history of falling against the dollar (USD). The value of the rupee depreciated from 63.33 INR in December 2014 to almost 82 INR in January 2023. A weaker INR impacts all USD-related expenses, including the education costs of sending children abroad. Here’s an example of how the INR’s depreciation affects parents who save in rupees. We’ve kept the tuition cost constant for nine years in the following table:

| Currency | June 2014 | January 2023 | |

| Tuition | USD | 30,000 | 30,000 |

| Living expenses | USD | 50,000 | 50,000 |

| Total costs (tuition + living) | USD | 80,000 | 80,000 |

| 1 USD = | INR | 73.12 | 81.66 |

| Total costs of college | INR | 58,49,000 | 65,32,800 |

How can parents beat education inflation and currency depreciation?

Smart investment planning is the best way to avoid education inflation and currency depreciation. Allocating funds for future education must begin when a child is young. Doing so provides a longer investment horizon of 10-15 years, which enables parents to accumulate a substantial corpus. But strategising which avenues to invest in is equally important. Here are some investment opportunities parents can explore:

1) Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diverse portfolio of assets. While there are several types of mutual funds, parents looking to build capital for their children’s future education should consider the following:

- Equity Funds:

Equity Funds aim to provide capital appreciation over a long period by investing in equity shares, especially for those who aren’t seasoned stock market players. The financial management of these funds is handled by professional fund experts who handle the market’s volatility. Over a more extended investment period, equity funds can potentially deliver inflation-beating returns, which can help a parent build a substantial corpus to fund their child’s education.

- Systematic Investment Plan (SIP):

A SIP is an ideal investment channel for young parents as it enables them to invest a fixed amount of money at regular intervals—either monthly, quarterly or annually. Parents must invest in SIPs sooner than later. Doing so enables them to build significant savings over time and meet their goals. Here’s how investing in SIPs can help:

| Target Amount | 1,00,00,000 INR |

| Horizon | 15 years |

| Risk | High |

| SIP | 17,018 INR |

| Actual Wealth Accumulated | 1,00,00,153 INR |

| Portfolio XIRR | 14.57 percent |

2) US stocks and ETFs

Investing in US markets like the New York Stock Exchange (NYSE) and the Nasdaq enables Indian parents to raise dollar-denominated funds for their child’s education and withstand currency depreciation. They need not worry about losing their savings to the fluctuating currency exchange rate.

The best-performing stocks in the US are Facebook, Apple, Amazon, Netflix, and Google, popularly known as the FAANG. Parents may also choose to invest in other popular stocks like Microsoft and Tesla.

If investing in the US is an option, consider Exchange Traded Funds (ETFs). Like mutual funds, ETFs are several stocks clubbed together and traded on markets like NASDAQ. These stocks track indices like S&P 500 or one sector like the technology or automotive industry.

EduFund is India’s first investment app dedicated to helping parents save and invest for their children’s education. It offers several options to invest in US stocks and ETFs, domestic mutual funds and other investment avenues that beat education inflation and support their children’s dreams. Better still, it has a team of financial experts who offer guidance at every step of your financial planning. Consult a professional before investing your savings.

Visit EduFund to explore saving plans and talk to financial experts!